Contents

Overview

Helpful to determine how many lots are bought/sold in FX Swap Point Arbitrage trading. Daily Range in this articles is calculated based on data from “Historical Data of Click 365″.

*Data till November 15, 2024 is used

We have three types of Daily Range for this trading.

- Difference between High and Close**(=HighーClose)

showing the price moving upward based on closing price in the previous trading day - Difference between Close** and Low(=CloseーLow)

showing the price moving downward based on closing price in the previous trading day - Difference between High and Low(=HighーLow)

showing general Daily Range

**Closing price in the previous trading day

The first and second Daily Range is an indicator in FX Swap Point Arbitrage trading and lower risk takers can use the third one.

The reason closing price in the previous trading day is incorporated into the first and second Daily Range instead of open price in the trading day:

- It’s hard to continue this trading based on open price getting early morning and confirming open price in the first trading day in new week

- Sometimes it happens the difference between closing price in the previous day and open price in the day is over 3% in the first day in new week or when financial situation is unstable

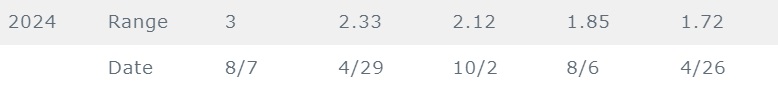

Description of table

The table below consists of the largest top 5 daily range in 2024. The largest is 3 on August 7, the second is 2.33 on Apr 29 and so on.

*The unit isn’t PIPS

※Updating contents hereafter

Largest Top 5 Daily Range of currencies against yen

Largest Top 5 Daily Range of others

| EUR/USD | GBP/USD | AUD/USD |

| NZD/USD | USD/CAD | GBP/CHF |

| USD/CHF | EUR/CHF | EUR/AUD |

| GBP/AUD | EUR/GBP |