Here are three types of Daily Range in this article.

[Daily Range 1] Difference between High and Close*1 (=High – Close*1)

[Daily Range 2] Difference between Close*1 and Low (=Close*1 – Low)

[Daily Range 3] Difference between High and Low (=High – Low)

*1 Closing price in the previous trading day

** Data till November 15, 2024 is used

** Refer to “Largest Top 5 Daily Range by year” for the description of tables below

Contents

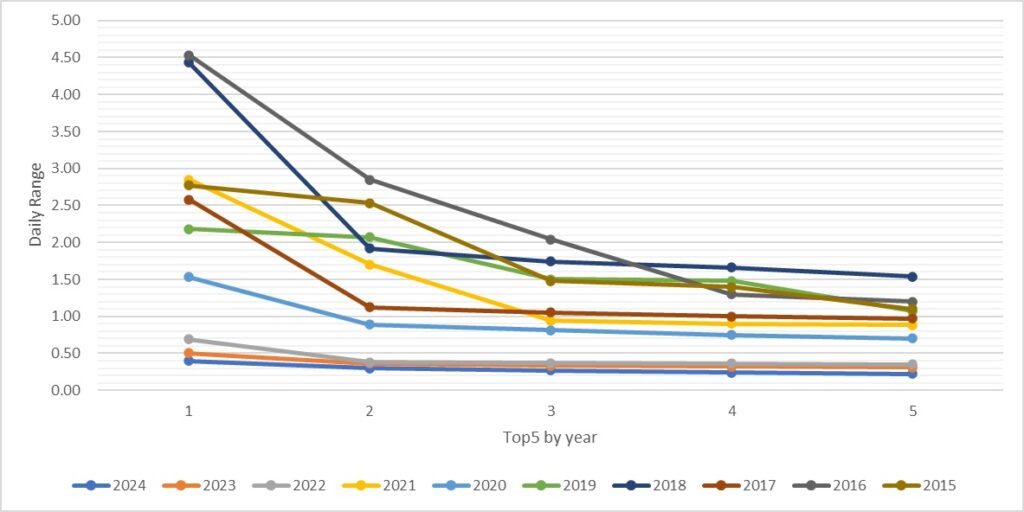

Daily Range 1: Difference between High and Close(=High – Close)

There is six days when Daily Range exceeds 1.2 since 2015; this figure, 1.2, can be an indicator in an upward direction for FX Swap Point Arbitrage trading.

| 2024 | Range | 0.26 | 0.23 | 0.21 | 0.19 | 0.18 |

| Date | 2/13 | 5/27 | 2/9 | 4/1 | 4/29 | |

| 2023 | Range | 0.46 | 0.33 | 0.31 | 0.28 | 0.21 |

| Date | 8/24 | 3/10 | 5/15 | 7/3 | 8/10 | |

| 2022 | Range | 0.48 | 0.41 | 0.39 | 0.39 | 0.37 |

| Date | 6/24 | 1/3 | 6/27 | 6/3 | 1/12 | |

| 2021 | Range | 2.18 | 1.8 | 1.69 | 1.18 | 0.86 |

| Date | 12/20 | 12/21 | 12/23 | 11/24 | 12/24 | |

| 2020 | Range | 1.02 | 0.61 | 0.58 | 0.57 | 0.54 |

| Date | 11/9 | 11/11 | 3/10 | 3/13 | 3/24 | |

| 2019 | Range | 1 | 0.95 | 0.95 | 0.79 | 0.77 |

| Date | 3/26 | 4/1 | 3/25 | 5/10 | 1/4 | |

| 2018 | Range | 1.69 | 1.6 | 1.07 | 0.85 | 0.82 |

| Date | 8/15 | 8/14 | 9/13 | 9/24 | 5/28 | |

| 2017 | Range | 0.86 | 0.75 | 0.7 | 0.58 | 0.56 |

| Date | 4/24 | 1/12 | 2/9 | 1/20 | 10/11 | |

| 2016 | Range | 1.18 | 1.1 | 1 | 0.97 | 0.94 |

| Date | 1/29 | 6/23 | 7/12 | 5/24 | 3/1 | |

| 2015 | Range | 2.31 | 1.12 | 0.96 | 0.9 | 0.86 |

| Date | 11/2 | 7/28 | 8/25 | 6/11 | 6/22 |

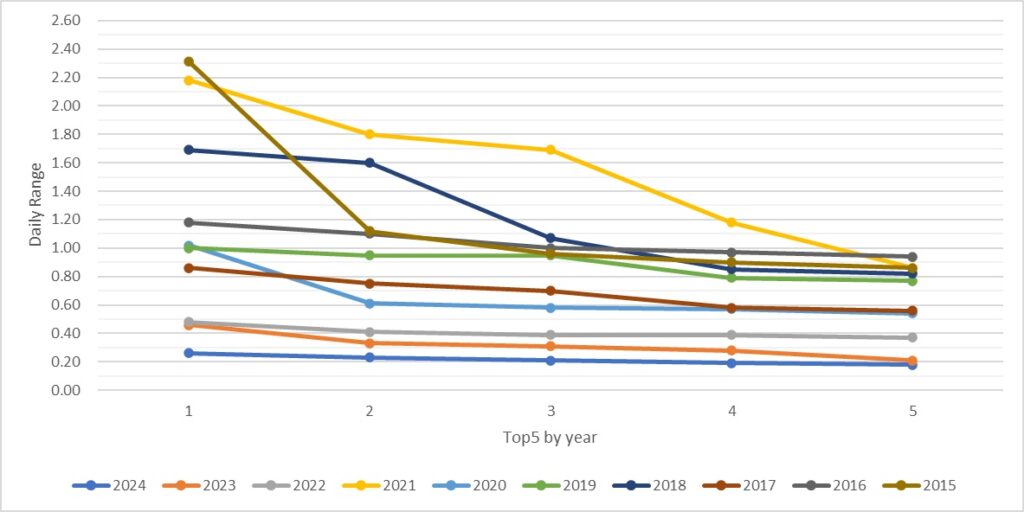

Daily Range 2: Difference between Close and Low (=Close – Low)

There are ten days when Daily Range exceeds 2.0 since 2015; this figure, 2.0, can be an indicator in a downward direction for FX Swap Point Arbitrage trading.

| 2024 | Range | 0.4 | 0.3 | 0.27 | 0.24 | 0.22 |

| Date | 8/5 | 4/12 | 3/13 | 5/1 | 1/23 | |

| 2023 | Range | 0.5 | 0.36 | 0.33 | 0.32 | 0.31 |

| Date | 6/7 | 3/24 | 6/23 | 5/12 | 7/18 | |

| 2022 | Range | 0.69 | 0.38 | 0.37 | 0.36 | 0.35 |

| Date | 2/24 | 1/3 | 12/20 | 1/4 | 1/13 | |

| 2021 | Range | 2.85 | 1.7 | 0.94 | 0.9 | 0.88 |

| Date | 3/22 | 11/23 | 11/30 | 12/20 | 12/21 | |

| 2020 | Range | 1.53 | 0.89 | 0.81 | 0.75 | 0.7 |

| Date | 3/9 | 8/10 | 7/3 | 11/23 | 3/16 | |

| 2019 | Range | 2.18 | 2.07 | 1.5 | 1.48 | 1.07 |

| Date | 8/26 | 1/3 | 3/28 | 3/22 | 3/27 | |

| 2018 | Range | 4.43 | 1.92 | 1.74 | 1.66 | 1.54 |

| Date | 8/10 | 8/13 | 8/6 | 8/17 | 5/23 | |

| 2017 | Range | 2.58 | 1.12 | 1.05 | 1 | 0.97 |

| Date | 10/9 | 12/14 | 1/9 | 1/11 | 1/5 | |

| 2016 | Range | 4.53 | 2.85 | 2.04 | 1.3 | 1.2 |

| Date | 6/24 | 11/9 | 5/4 | 4/28 | 6/16 | |

| 2015 | Range | 2.77 | 2.53 | 1.48 | 1.4 | 1.1 |

| Date | 8/24 | 6/8 | 6/29 | 8/20 | 12/11 |

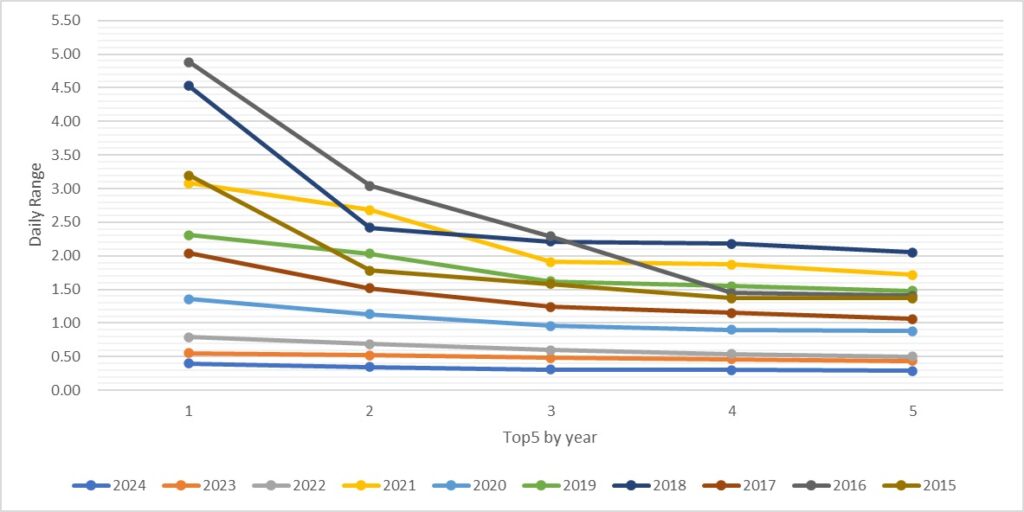

Daily Range 3: Difference between High and Low (=High – Low)

| 2024 | Range | 0.4 | 0.35 | 0.31 | 0.3 | 0.29 |

| Date | 8/5 | 3/13 | 1/23 | 4/12 | 8/7 | |

| 2023 | Range | 0.55 | 0.52 | 0.48 | 0.46 | 0.44 |

| Date | 6/7 | 8/24 | 5/12 | 6/23 | 3/10 | |

| 2022 | Range | 0.79 | 0.69 | 0.6 | 0.54 | 0.5 |

| Date | 1/3 | 2/24 | 6/9 | 10/21 | 6/24 | |

| 2021 | Range | 3.08 | 2.68 | 1.91 | 1.87 | 1.72 |

| Date | 12/20 | 12/21 | 3/22 | 12/23 | 11/23 | |

| 2020 | Range | 1.36 | 1.13 | 0.96 | 0.9 | 0.88 |

| Date | 3/9 | 8/10 | 7/3 | 11/9 | 9/28 | |

| 2019 | Range | 2.31 | 2.03 | 1.62 | 1.55 | 1.48 |

| Date | 8/26 | 1/3 | 3/28 | 3/22 | 4/1 | |

| 2018 | Range | 4.53 | 2.42 | 2.21 | 2.18 | 2.05 |

| Date | 8/10 | 8/15 | 8/13 | 5/23 | 8/14 | |

| 2017 | Range | 2.04 | 1.52 | 1.24 | 1.15 | 1.06 |

| Date | 10/9 | 1/12 | 1/9 | 12/14 | 1/11 | |

| 2016 | Range | 4.88 | 3.04 | 2.29 | 1.45 | 1.41 |

| Date | 6/24 | 11/9 | 5/4 | 1/29 | 4/28 | |

| 2015 | Range | 3.2 | 1.78 | 1.58 | 1.37 | 1.37 |

| Date | 8/24 | 8/20 | 11/2 | 6/8 | 12/11 |